The Uzbek Consumer Opportunity

Capitalising on Uzbekistan's demographic dividend and tailwind of technology adoption

With population of 36.2 million Uzbekistan has the largest potential consumer market in Central Asia. It is also a young country, with more than two-thirds of the population being of working-age (15-64), contributing to a strong labour force. The country has maintained a high GDP growth, averaging 5.8 % over the last ten years. Despite the COVID-19 pandemic, thanks in part to reforms to liberalize prices and remove barriers to domestic and international trade, the country’s economy was one of the few in the Europe and Central Asia (ECA) region to avoid negative dynamics in 2020, showing GDP growth of 1.7%.

Although these quantitative figures look impressive, they are incomplete without a proper understanding of the qualitative context and breakdown of the 7.1m households and incomes within that population. Digital penetration is still nascent in the country and the majority of the population are still unaccustomed to transacting online. This blog post analyses the local market dynamics to identify the correct strategies for consumer-focused startups to succeed, and follows the previous one on the Pakistani consumer opportunity. It is based on our experience, multiple conversations in the ecosystem and the latest economic survey conducted by research organizations.

The Uzbek Demographic Dividend

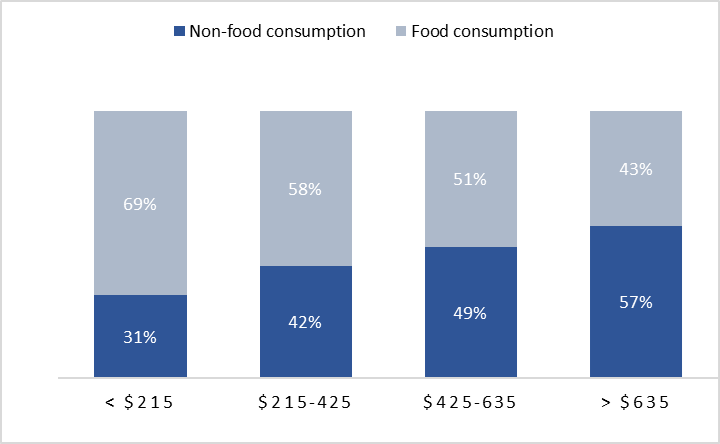

From the above table we can see that 8% of Uzbek households are below the poverty line with a monthly household income below $215. Analysis of differences in spending patterns between households with different incomes shows that households with lower incomes (<$215) spend 69% of their expenses for food products and only 31% for non-food goods and services (i.e. transportation, healthcare, education etc.). These households are extremely price sensitive and time insensitive. This group is represented mainly by the agrarian labour force living in rural areas of Uzbekistan and is a long way from adopting technology for day-to-day or one-off purposes.

With an increase in income levels, the share of food products in the consumption structure decreases significantly. The share of food in the consumer basket of households with an income of $215-425 is 9% lower than group 1. This is the largest group, accounting for 32% of all households, and they too are price sensitive and partially time sensitive. These households are lower middle-class families but with the potential of becoming middle-class over the next five to ten years.

The next group of households with an income of $425-635 account for 30% of households. With their consumption of food products being 51% vs. 49% of non-food goods and services, these households can be classified as middle-class consumers. The last group of households accounting for 30% of all households generate an income above $635 per month. These households differ from other groups of households for their largest non-food consumption (57%). The large majority of these households (95%) are middle-class and upper middle-class of Uzbekistan while a small minority (5%) of them are wealthy population. Together, income groups three and four are the two that can begin to be targeted by consumer focused startups in the country.

The survey also shows that older people tend to spend a larger share of their income on food (86%) than young people. This segment are unlikely to be users of startup products or services, due to a lack of disposable income and low digital literacy. The relatively high share of non-food products in consumption structure of the population aged 30-55 years is due to the fact that representatives of this group are mainly payers of utilities and other financial obligations. This group has the combination of disposable income and propensity to adopt technology, although requiring a degree of education that may increase customer acquisition cost and time to onboard. However, we tend to see that this results in higher retention rates once customers are onboarded.

Digitalising Uzbekistan’s Retail Opportunity

According to a recent report by KPMG, Uzbekistan’s retail market was valued at $14.0 billion as at the end 2022 and was projected to reach $19.6 billion by the end of 2027. This seems realistic given the households’ annual consumption potential of nearly $40-50 billion. Also, as per KPMG, the country’s e-commerce market accounts for 2.2% of total retail market and was estimated to be $311 million at the end of 2022, having grown 5 times since 2018. Subsectors of Uzbekistan’s e-commerce market included:

During the period of 2018-2022, Uzbekistan had the fastest growing e-commerce penetration rate in Central Asia. The key factors contributing to the growth of e-commerce market penetration include:

Shift of the population from offline to online (e.g. number of internet users -26.7mn in 2023 vs. 22.0mn in 2019, of which nearly 23 million internet users have access to internet on their mobile (smart)phones. This is a good indicator and this should be taken into account by e-commerce players while working on product development, GTM and marketing strategies; number of mobile communication users – 30mn in 2023 vs. 24.8mn in 2019)

the state-backed initiatives and reforms supporting the industry (favourable regulatory framework for mobile banking, online payment and fintech players as well as ongoing efforts to combat the shadow economy)

emergence of e-commerce players in local market (Zood, Uzum, Korzinka Go, Olcha, Mediapark etc.)

According to KPMG, Uzbekistan’s ecommerce market is projected to grow a substantially, with estimates ranging from lower-end of $1.8bn to higher-end of $2.2bn by end of 2027. CAGR (2022-2027) is projected to be between 41.4% and 47.4%. Further e-commerce market growth will be supported by:

strong fundamentals (thriving economy, growing household incomes, positive demographics, increasing level of internet penetration, increasing urbanization, government support for private sector)

changing lifestyles and consumer habits (e-commerce benefits for consumers in the form of generally lower prices, wider product variety and the convenience of anytime, anywhere shopping)

growth of local e-commerce players through high-scale investments in building ecommerce infrastructure / ecosystem and education of consumers to online shopping (e.g. Uzum had over 13mn mobile app downloads operating the largest logistics network with 500 pick-up points across the country)

These factors collectively contribute to the ongoing transformation and expansion of the e-commerce market in Uzbekistan. In spite of the above factors, Uzbek e-commerce market experiences some development restraints:

From the supply-side perspective, local market players are proactively engaging in investments to develop infrastructure, logistics, and fintech solutions. These efforts aim to mitigate the impact of the current restrictions and capitalize on emerging opportunities.

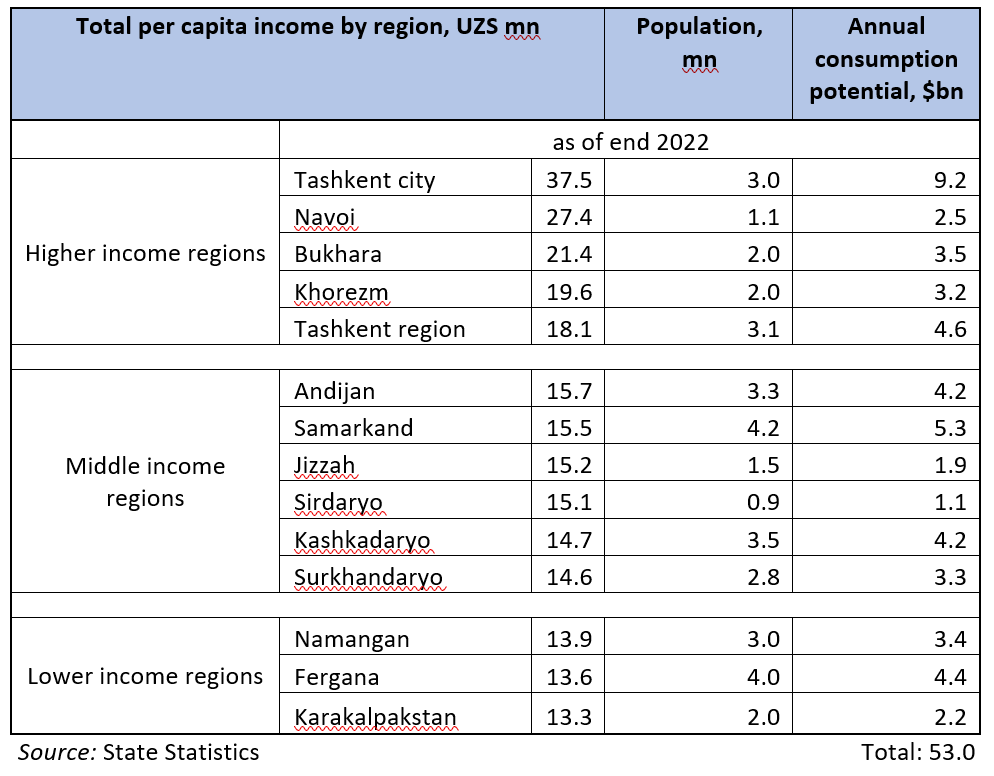

Tashkent city and Tashkent region, as one whole region, represent the largest market (approx.$14bn) for consumer-targeted businesses; that’s why startups & e-commerce players launch and focus on this region. Considering that the majority of private & large businesses, including state-owned, are headquartered in this region, most of the households in Income Group Three and Four are located here. This well explains why KorzinkaGo (a grocery-delivery arm of Korzinka formerly known as LeBazar) only focuses on Tashkent-city households even though the chain has offline stores and logistics capacity across all major cities and towns of Uzbekistan. Although Navoi, Bukhara, Khorezm are among higher-income regions, the e-commerce market remains undeveloped due to i) small population size ii) remoteness from Tashkent city (600-1000km) iii) traditional consumer habits. Only large players like Uzum and Zood which have the capacity to provide quality delivery are able to serve the e-commerce consumers of this region.

Regions like Samarkand, Fergana, Andijan, Kashkadaryo aren’t from higher income regions, but thanks to their large population they are targeted by some players as next scale-up destinations (e.g. ArzonApteka having small teams in Samarkand and Fergana; food delivery apps such as Yandex Eats, Express24, Rasta etc. actively expanding into these cities). Also, in parallel to Uzum and Zood, smaller players especially online fashion stores are trying to serve consumers of these regions by outsourcing third-party logistics services (e.g. BTS, which can be a comparable to Fargo of Zood).

Conclusion:

Over 2018-2022, the e-commerce market in Uzbekistan has exhibited remarkable growth performance and it is forecasted in the coming 4-5 years to follow the growth trajectory of its regional peers (Kazakhstan, Russia). As Uzbekistan is emerging as the largest consumer market in the region, more and more regional players are entering the country’s e-commerce market: in 2022 Uzum launched building the national ‘champion’ of e-commerce business. In 2022, Russia’s Ozon and Wildberries entered the country. Although most of sales on these platforms are cross-border transactions at present, they are gradually developing own logistics capacity and infrastructure so that local merchants could also trade on them. These are strongly positive for Uzbek consumers.

The target audience for e-commerce businesses are households with Income Group Three ($425-$635) and Income Group Four (> $635). Thus, potentially 4.2 million households can become users of e-commerce platforms. These households spend half or more than half of their incomes for non-food items. These households are largely based in Tashkent city and central cities of regional provinces like Samarkand city, Bukhara city, Navoi, Andijan, Fergana, Namangan, Kokand and other major towns which have developed communication network and logistics systems.

Given that majority of e-commerce consumers in Uzbekistan are social network users (mainly Facebook and Instagram), e-commerce businesses should build their go to market around this audience. Facebook has over 7.0mn Uzbek subscribers, while Instagram has over 6.0mn. Conversions from these two are significant, motivating e-commerce players to allocate most of their marketing budgets to these platforms.

While general marketplaces are focusing mainly on Facebook and Instagram, online vertical businesses should improve their SEO tools via Google and Yandex as representatives of niche businesses they serve specific audiences and their set of needs (e.g.,. beauty and healthcare goods, apparel, children’s wear etc.)

E-commerce businesses can also build partnerships with MNOs and other non-competing businesses through exchange or sale of customer base (including only consumers phone number and historical purchase records). It is estimated that a mobile subscriber who purchases internet traffic for UZS50,000/month is a potential e-commerce consumer. Similarly, a household making an order on ‘KorzinkaGo’ for average of UZS350,000 and staying active at least within the last 3 months uses other e-commerce apps as well. We have seen already a few incidents of such partnerships among local players.

It is also worthwhile to note that Uzbekistan’s current e-commerce consumer base is considered a mass market; we don’t have online businesses, for example, focusing only on wealthy people or only budget consumers. All e-commerce platforms are dedicated to middle class and upper middle-class consumers. They don’t employ any differentiated pricing strategy or customized marketing strategy. However, in 5-6 years’ time period there will be a need for servicing high-end and wealthy e-commerce users.

Sturgeon Capital has made over a dozen investments in the Uzbek ecosystem, including several of the largest consumer facing businesses such as Zood and ArzonApteka. We believe there is a significant long-term opportunity over the next 10 years to build local champions that can capture the secular trend of technology adoption among a young and increasingly affluent population. It will take time for the market to mature and startups who recognise this and can acquire customers in an efficient manner with high retention will prosper. Should you have any questions about the information or conclusions in this report, please don’t hesitate to contact one of the team.

During quarantine or just remotely, I recommend buying games on GGSel - https://ggsel.net