WHY WE INVESTED SERIES

The “Why We Invested” series, published on our Terra Incognita blog, aims to provide investors and founders with insights into the investment opportunities in Emerging Asia, as well as Sturgeon Capital’s strategy to capture them. Each article presents a distilled version of the 20-30 page internal investment memo that we prepare for each company, highlighting the key factors that we believe will drive the success of our investments. We welcome your feedback on our investment thesis and the specific company dynamics so that we can share more information and, hopefully, improve as investors.

SUMMARY

Farel is building the all-in-one operating system for airlines in emerging markets. This long tail of the aviation industry is underserved by the incumbent enterprise solutions, unable to afford the in-house technology teams necessary to implement and maintain their archaic solutions. Despite this, multiple new airlines are being launched each year in emerging markets to meet the demands of the growing middle class for domestic and international air travel. Their challenges extend beyond just the core systems to managing third-party distribution integrations and FinTech solutions. This is Farel’s opportunity.

Sturgeon Capital’s second fund, SEO II, invested in Farel in Q1 2023 as part of their Seed round alongside Y-Combinator, Bloomberg Beta and SNR. In this post, Robin Butler, who led the deal, explains why we are so excited to be backing Askhat and what he is building at Farel.

THE PROBLEM & OPPORTUNITY

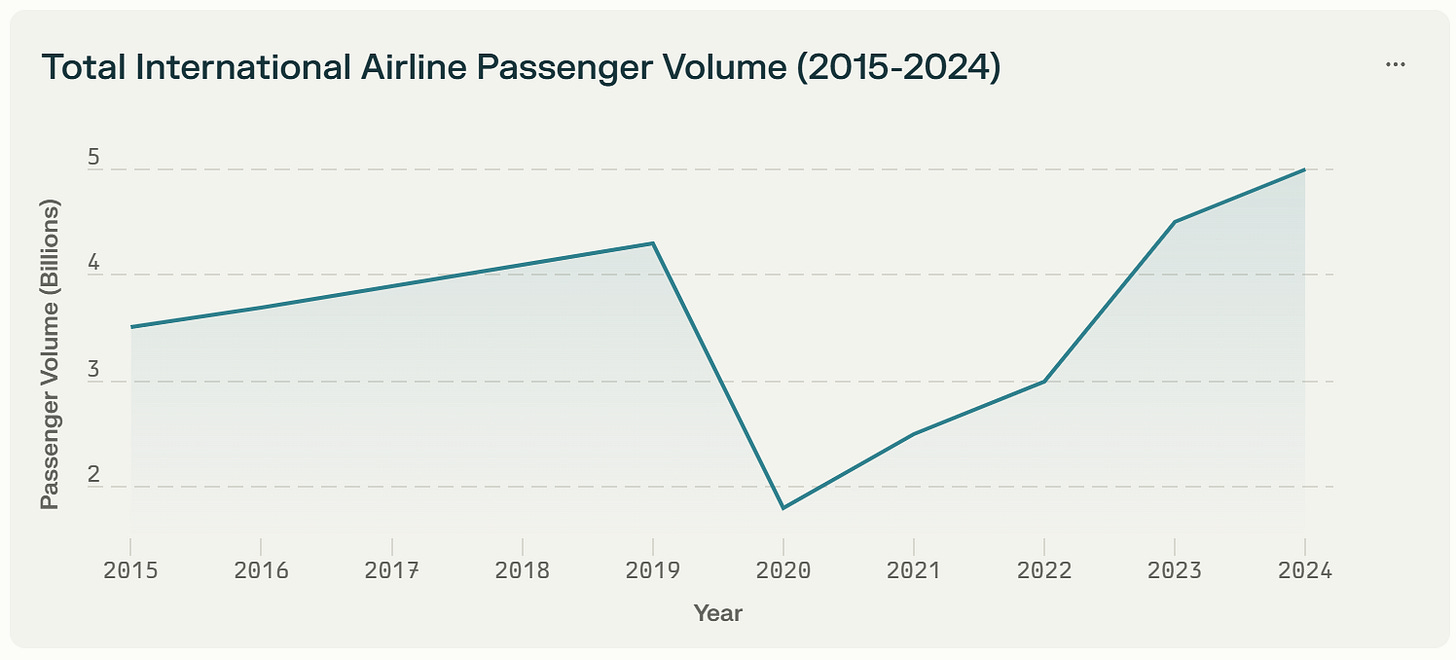

The global airline industry is developing rapidly. Air travel has rebounded from the impact of the Covid pandemic; nearly 5bn passengers travelled by air in 2024, generating $744bn in passenger revenues. While all markets are growing, emerging markets are driving growth for the broader industry. Airlines in Asia-Pacific and Latin America posted a 26.0% and 14.4% rise, respectively, in international traffic for 2024 compared to 2023, while North America and Europe saw growth of only 6.8% and 9.4%.

Source: IATA

This is underpinned by significant investment in infrastructure and new airlines, itself a response to the rising incomes and greater propensity and ability for domestic and international travel. In South Asia, for example, Bangladesh and Pakistan have each launched three new airlines in the last 10 years, with Dhaka scheduled to inaugurate a new international terminal in 2026. In India, the country's fleet is projected to double by 2035, supported by the construction of more than a dozen new airports.

While the industry is changing, the technology it runs on has not. It is a market dominated by enterprise-focused behemoths such as Amadeus (founded in 1987!). While Amadeus might be the right solution for a global airline like Qatar Airways, it is not a fit for smaller ones in emerging markets. Not only is it too expensive, but it requires an in-house technology team to manage and implement, something that smaller airlines can’t afford. Outside of the Amadeus-type products, the industry is highly fragmented, with multiple pieces of software that handle each part of an airline’s operations. This, again, requires an internal technology team to implement and manage. For emerging airlines, the alternative is to either commission a local software house to build a bespoke solution or to manually handle their flights through email and Excel (yes, really!).

It is these developing airlines in emerging markets that are Farel’s core customer base. There are more than 1,000 such small airlines, which represent around 20% of global passenger volumes or more than $200bn in annual revenue. In the context of the markets they operate in, these airlines are particularly price-conscious and prioritise affordable, all-in-one solutions. The importance of affordability is clear in the per-passenger profit data: carriers in Africa and the Asia-Pacific regions, for example, earn $1.00 and $1.80 profit per passenger, respectively, compared to $9.20 in Europe or $11.80 in North America.

Assuming ~5% of revenue is spent on technology solutions, Farel’s Serviceable Available Market (SAM) among small airlines is $1bn. That number is only part of the picture, however. These airlines don’t just need a core operating system; they need the ability to upsell customers with products such as insurance; integrations to distribution channels, such as Expedia or Booking.com; and access to financial solutions, including payments and lending. Any core operating system that can handle each of these is also uniquely well-positioned to develop AI agents that can automate many of the labour-intensive tasks that consume an airline’s profits.

THE FOUNDERS

Farel was founded by Askhat Omarov, a serial entrepreneur from Kazakhstan, with a successful exit in the travel space. His first business, Asia InterCommunications, was a Kazakhstani-based systems integrator specialised in delivering IT solutions for large and medium-sized businesses. It became one of the largest technology partners of Cisco Systems in the country and 3X Cisco Systems Best Partner in Kazakhstan. In 2015, Askhat founded Santufei.com, an Online Travel Agency (OTA) offering flight and rail tickets. With $350k of seed capital, this business scaled to $40M in GMV before being acquired by Kaspi.kz in 2020. (Kaspi Travel did ~$1bn in GMV in 2024, as part of Kaspi’s broader ecosystem).

Sturgeon has been fortunate to know Askhat for nearly four years. Askhat is one of a growing number of serial entrepreneurs in Kazakhstan and Central Asia who are leveraging their experience building domestic or regional businesses to tackle global problems. His firsthand experience working with the old fashioned and inefficient operating systems used by airlines, combined with his network within the industry, gives him a distinct advantage in building Farel as a viable alternative. Askhat’s selection as the first Kazakh founder to join the Y Combinator S20 batch was a leading indicator and recognition of his abilities and vision.

THE SOLUTION

Farel is “the Operating System for next-generation airlines” that “delivers one seamless, all-in-one, software platform engineered for growing airlines”. Key features include:

Comprehensive Operations Management: Covers inventory management, departure control, and other critical airline functions, eliminating the need for multiple vendors or integrations.

Revenue Maximization: Optimizes customer conversions through a robust Internet Booking Engine (IBE) multichannel distribution (website, mobile app, OTAs, agencies), and a branded mobile app for mobile-only travellers.

Integrated Payment Solutions: Offers seamless booking with multiple payment options.

Ease of Use: Airlines can launch websites in days without coding and utilize APIs to increase visibility on OTAs and meta-search platforms.

Cost Efficiency: Simplified pay-per-passenger pricing with no hidden fees, implementation costs, or monthly minimums.

Farel’s competitive edge comes from its simplicity of implementation yet completeness of product features. Whereas traditionally, an airline would have to stitch together products from multiple different providers and then keep a full-time tech team to maintain this bird’s nest of a solution, with Farel, they can rely on one solution that is constantly updated and improved by Farel’s experience working with airlines across the world. This allows airlines to focus on providing the best quality of service to their passengers, confident that Farel will provide the best quality of service and support behind the scenes.

Having such a strong product does not make this an easy market for Farel to work in. The team must contend with the usual inertia and aversion to change that blights any large corporation, no matter how bad their existing solution might be. Securing the first live customer was key to overcoming this, as it allowed Farel to point to an airline that was actively booking and transporting customers entirely through their system. While Farel faces long enterprise sales cycles, the contracts it signs are both long-term and high-value, offering multiple opportunities to increase Annual Contract Value (ACV) through new products and features. Askhat’s experience as a serial entrepreneur equips him with the patience to manage these challenges, knowing the rewards awaiting on the other side.

WHY WE INVESTED

Having known Askhat for several years and followed the early progress of Farel, Sturgeon’s decision to invest was based on the following thesis:

Askhat’s track record as an entrepreneur and experience with Santufei make him uniquely well-suited to build and scale an enterprise solution in the aviation industry. Airlines are not simple organisations to work with, so Askhat’s experience is invaluable for navigating the intricacies of their idiosyncrasies and close contacts.

It is a large, complex and growing market that has seen little innovation in the last 20-30 years. This complexity prevents many from trying to build a solution that can address the inherent challenges in the industry. Yet, the market is growing quickly, especially in emerging markets, and the existing solutions are not fit for purpose in the 21st century. With $200bn in revenue and at least $1bn in technology spend, there is a long runway of growth for Farel to capture and an opportunity to embed and overlay additional products and services that can increase its long-term revenue potential.

The product Farel has built is a thing of beauty. From the customer perspective, the UX and UI are better than those of most airlines, which are typically larger with significantly greater IT budgets. On the backend, it seamlessly integrates with other products to increase the airlines’ operating efficiency, enabling them to focus on customers instead. Whether for startup airlines just getting off the ground, existing airlines that are running on email or Excel, or existing ones using outdated software, Farel provides the solution they need.

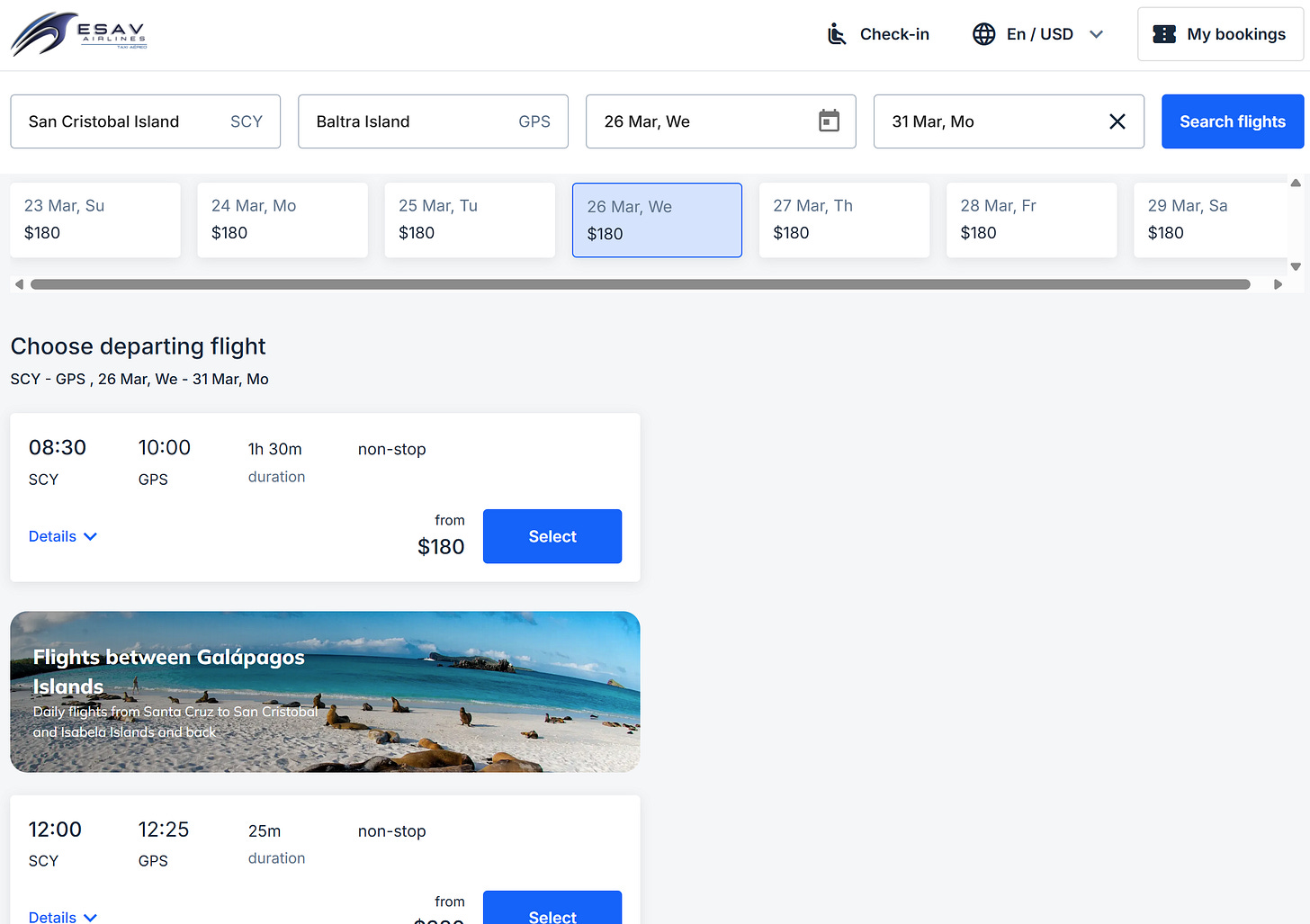

At the time we invested, Farel had not yet launched its first airline. Since then, Farel has launched airlines across multiple continents, operating 100% on Farel's software. The first was a small Ecuadorean airline, Esav Airlines, that flies between the Galapagos Islands. Before using Farel, passengers could only book flights on Esav through WhatsApp (with PayPal for payment), and the airline was effectively operating offline. Since launching on Farel, Esav has already quadrupled its revenues!

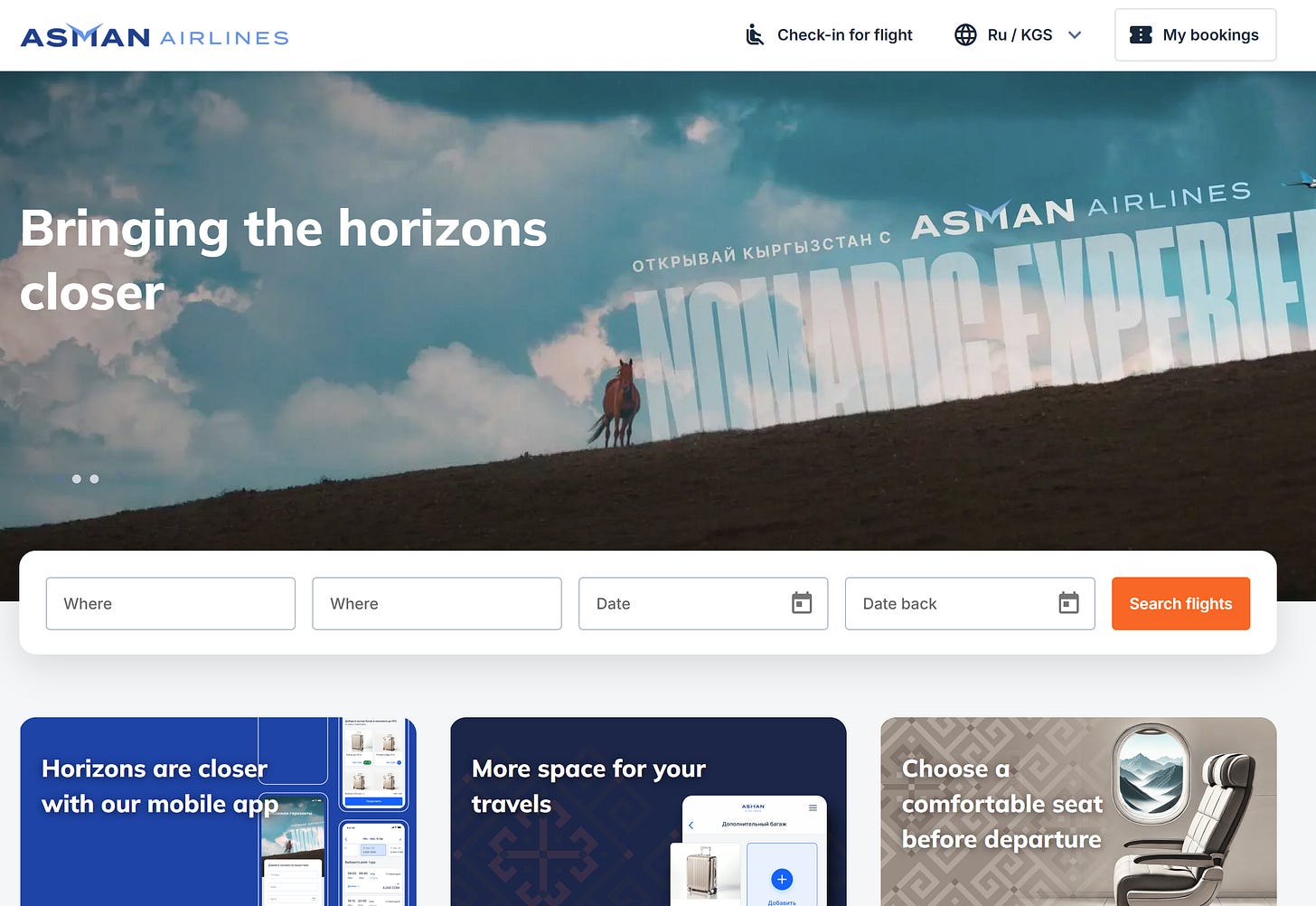

The second was Asman Airlines, a startup, state-owned airline aiming to connect cities with rural regions throughout Kyrgyzstan. Asman started in the third quarter of 2024 with its first aircraft and has already launched a second one before the end of the year, with plans to add more aircrafts as it scales across the country.

These cases have validated the thesis that Farel can not only help airlines operate more efficiently but can also boost revenues through greater online visibility and an improved customer experience. The product can also play a meaningful role in driving social and economic impact – enabling better connectivity and inclusion for rural areas, empowering small businesses with digital tools, and stimulating tourism and local economic growth in emerging markets.

In the long-term, Farel’s position as the core operating system and system of record for airlines is a competitive moat, which the company can deepen by leveraging its learnings from multiple airlines in different markets to develop new features and products that increase the stickiness of its customer base. It also opens up the opportunity to build embedded AI agents that can use the data from across the customer base to enable each individual customer to make better decisions, operate more efficiently and maximise revenues. Financial services are also an interesting angle for Farel to build the payment rails for their customers as well as lending products. As a pure software product, Farel has a $1bn revenue opportunity; however, with these additional products and services, the true revenue opportunity can be 5-10x higher.

LOOKING AHEAD

At Sturgeon, the majority of our investments and the capital we deploy focus on local and regional champions, such as Cargon, which we wrote about in our previous “Why We Invested” piece. Farel falls into a second bucket of investments, where we back second+ time entrepreneurs who have built a level of domain expertise, which we believe gives them the insights and ability to tackle a global problem at scale. Askhat’s experience, combined with the YC network and support of international investors, we believe makes him the right person to do this.

Today, we think Farel is at an inflection point. The examples of Esav and Asman have validated that Farel’s product solves the problems of airlines in emerging markets and that they are willing to pay for it. Encouragingly, the company is also starting to see a network effect among other airlines in Latin America and Central Asia, attracting inbound interest from those who have seen Farel’s product live with their regional competitors. With a proven product, strong leadership, and the support of prominent investors, Farel is in a strong position to build on its solid foundation and establish itself as the leading solution for airlines in emerging markets.

If you are an investor who is interested in experienced founders solving complex problems in large markets or know an airline that needs a smarter, all-in-one solution, then please get in touch!